total property tax in frisco tx

Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. The tax rates are stated at a rate per 100 of assessed value.

Below 100 means cheaper than the US average.

. Monday - Friday 8 am. For more information call 469-362-5800. Wednesday General Information Property taxes are local taxes.

About our Cost of Living Index DID YOU KNOW. While the proposed tax rate of 04466 per 100 valuation is consistent with Friscos 2019-20 tax rate the city expects to raise more revenue for maintenance and operations compared with the. All Frisco ISD taxes are collected by the Collin County Tax Office.

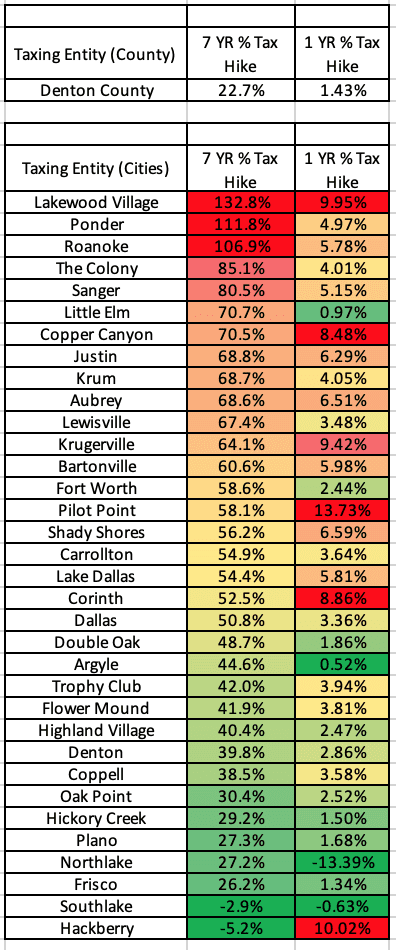

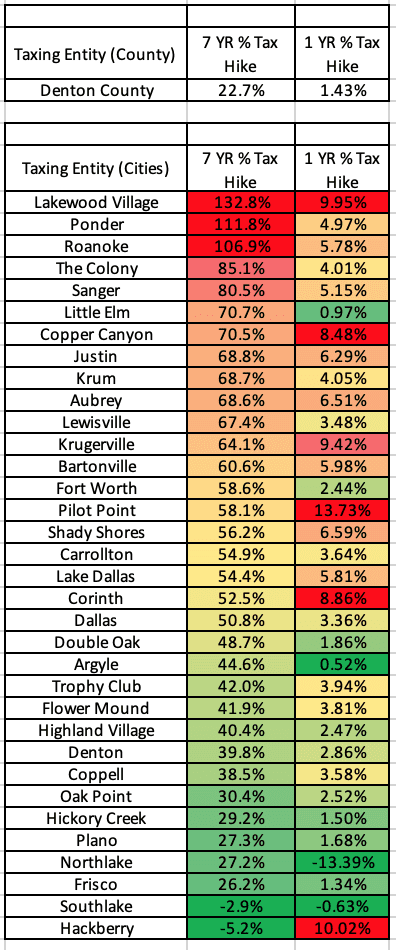

City of Frisco Base Property Tax Rate. Local officials value your property set your tax rates and collect your taxes. Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510.

Click here to customize. Above 100 means more expensive. For Sale - 4866 Jadi Ln Frisco TX - 519900.

Just Enter an Address. View details map and photos of this single family property with 3 bedrooms and 4 total baths. Overall the total taxable value of property within Frisco ISD rose 67 from 2020 to 2021 to 4658 billion.

State law governs how this process works. Expert Results for Free. Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510.

Frisco Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unaware that a property tax levy sometimes is more than it should be due to an inaccurate valuation. Frisco Texas and Austin Texas. Total property tax in frisco tx Monday July 25 2022 Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes Why Are Texas Property Taxes So High Home Tax Solutions What You Should Know.

Denton County Tax Collector - Frisco Office Contact Information. Find All The Record Information You Need Here. Ad Unsure Of The Value Of Your Property.

The state establishes the total amount of state and local funding due to school districts under Texas school finance law. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Here is some information about the current Frisco property taxes.

Those property owners living in Denton County will still receive 2 statements. 2022 Cost of Living Calculator for Taxes. Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years.

City of Frisco Total. The year-over-year appreciation of existing property including residential commercial land improvements and more was 16 in Collin County and 39 in Denton County. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes.

Property taxes in Texas are ad valorem meaning they are based on the 100 assessed value of the property. Just Enter Your Zip for Free Instant Results. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

Frisco Tax Rates for Collin County. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year.

6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map propertytaxcollincountytxgov 469-362-5800 Hours. Frisco Office 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 taxassessorcollincountytxgov 4693625800. Ad Just Enter your Zip Code for Property Tax Records in your Area.

Taxes in Frisco Texas are 131 more expensive than Plano Texas 100 US Average. Address Phone Number and Hours for Denton County Tax Collector - Frisco Office a Treasurer Tax Collector Office at Farm to Market Road 423 Frisco TX. Your Search for Real Updated Property Records Just Got Easier.

Easily Find Property Tax Records Online. 1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. Collin County Tax Assessor-Collector Frisco Office.

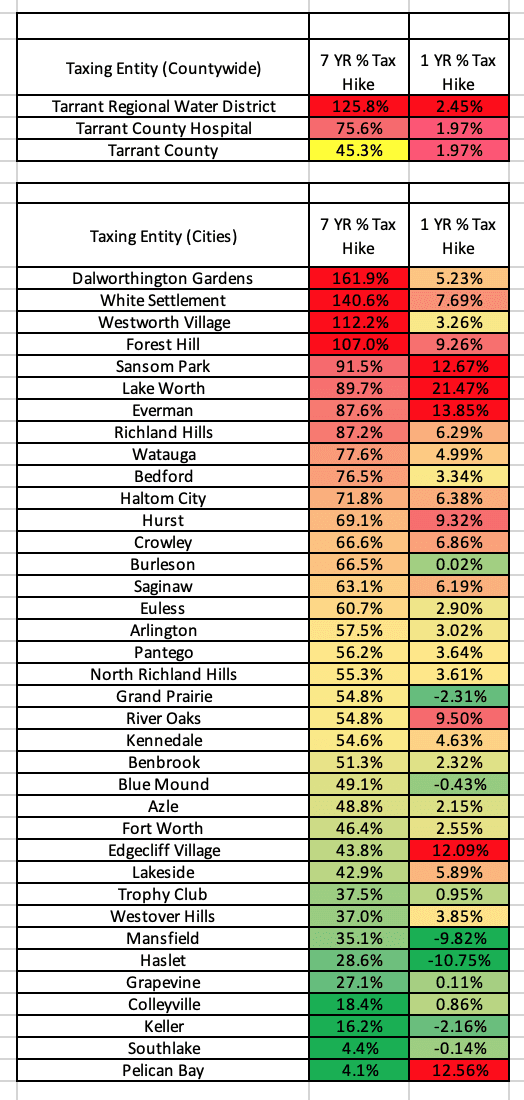

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

9 Homes For Sale In Plantation Resort Tx Propertyshark

14 Homes For Sale In Frisco Lakes By Del Webb Tx Propertyshark

What Is The Property Tax Rate In Frisco Texas

12005 Paducah Dr Frisco Tx 75035 Mls 14684581 Zillow

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

9 Homes For Sale In Plantation Resort Tx Propertyshark

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Beautiful Corner Lot Property In The Sought After Frisco Isd This Home Boasts 4 Beds 3 Baths And 2 Car Garage The K New Home Construction Home Buying Patio

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing

21 3 Million Emerald Cay Estate Providenciales Turks And Caicos Islands Spanish Colonial Homes Mansions California Homes

14 Homes For Sale In Frisco Lakes By Del Webb Tx Propertyshark

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Property Tax Rate In Frisco Texas